Piecing it All Together: The ABCs of TICs in San Francisco

Kevin+Jonathan help piece together how this unique property type is distinct from buying and owning condominiums and co-ops in the City and why they came into being (hint: it has to do with rent control)

HIDDEN AMONGST US

You May Encounter TIC Listings in San Francisco Without Realizing It

During your property search you will likely come across a seemingly incredible steal of a deal for a renovated space in an older Victorian and Edwardian building. This property has both the charm and character you’ve been searching for while also the modern kitchen, bedroom-bathroom count and finishes that you think are on-trend. Even better, the location. You’re in Noe/Mission/Hayes/Duboce/Telegraph Hill/ or some analogous neighborhood that has tree-lined streets and a mix of Victorians, Edwardians and more.

You’re excited. You think you’ve found it. How could someone overlook this deal? You may go to to the open house or you may scrutinize the listing information and in both cases you are likely to hear or read the words: “tenancy in common,” or an acronym T-I-C. You ask yourself: “what is that supposed to mean?

Congratulations, you’ve discovered a San Francisco treat — the TIC.

The best way of telling you what it means is telling you what a TIC is not.

A TIC unit may look like and feel like a condo. Heck, there’s even an HOA and monthly dues. Floor plans, ceiling heights, the front façade — all of it could look like its neighbor. Alternatively, a building with TIC units may look like a large apartment house with 5, 6, 10 or 12 units. When you’re at an open house, you may hear agents talking about ‘deeded’ spaces when they really should be saying, ‘assigned spaces.’ You may even hear a snippet about converting into condominiums at one point.

Tenancy-In-Common units — TICs for short — are a hybrid between a single-family house, apartment building and a condominium that are pretty unique to San Francisco, although they’re popping up in LA now too (think back to the Big Lebowski and where the Dude lived, 4 bungalows opening up onto a common yard/sidewalk area).

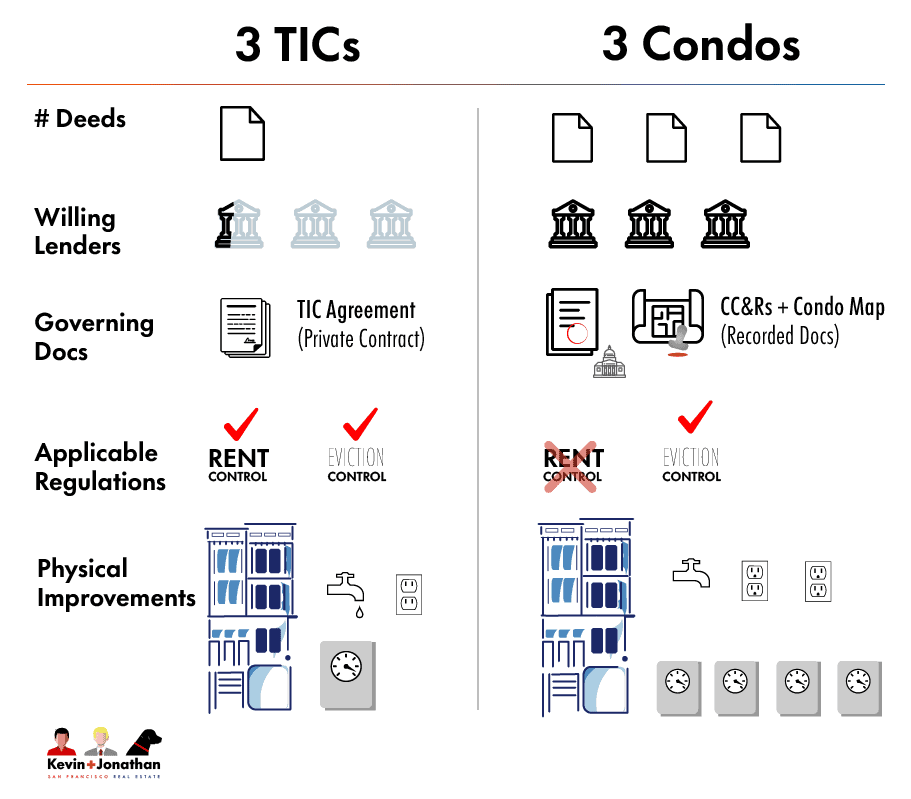

Like a house, a condominium will have its own assessor parcel number. A single condo building will have subdivided spaces inside; each 3-dimensional space is its own parcel with the common areas (walls, yards, driveways, and amenity areas in larger developments) are deeded to the homeowner association of of which each condominium owner is a member. Thus when you see a 3-unit Victorian condo building you will know there three deeds for the single building, all three of those condominium comprises the HOA. Same is true for 2-unit buildings or 300-unit buildings with the larger developments often having professional property management, amenities, and, as properties go up in price, onsite staff and amenities. Unlike a house or condo, a TIC property only has 1 title deed for the entire property, no matter how many ‘units’ there are in a building.

What you’re really buying when you’re getting a TIC is an undivided interest in the entire property. This is why families may purchase a house or condo as tenants in common so there are no percentages to quibble over. But when you’re buying a TIC unit, you are also agreeing to buy into and being bound by a private contract between all the other owners of the property — the TIC agreement. It’s the TIC agreement that spells out what percentage of the property you’re buying and what comes with that given interest along with what rules govern and, in a lot of cases, what types of financing will work.

Buying A San Francisco Tenancy in Common Unit Can Mean A Lot of Things. The One Common Thing is That They’re Unconventional.

YES TO THE TIC?

Owning beats renting. Remember that TICs will appreciate like other properties too, which means that there’s a fair chance that you should recover what you’ve paid into a property when you sell it down the line.

Historic and Well-Situated

One of the very reasons why an older building cannot be torn down is that it is, well, historic. In many cases a TIC building was an apartment building with many dating from the early part of the 20th Century, meaning Victorian, Edwardian and some Art Deco thrown in for good measure. These structures were built in the denser urban cores that so many folks want to be in.

(Yes, we know. There is an entire swath of mid-century TIC units particularly in the Upper Market, Diamond Heights and Twin Peaks area).

In An Unaffordable City — TICs are Just a Little More Affordable

TIC units represent an more (if just slightly) affordable way to enter the real estate market in San Francisco. The price difference between an equivalent condo can be astronomical. There are some notable exceptions, for reasons we explain elsewhere, the vast majority, a TIC will sell anywhere from 10 to 20 percent less than an equivalent condominium unit.

TIC homes also may be just what the doctor ordered for the time being. TICs are often the intermediate home for our clients — between the last rental they had and the big, forever home they get next. Because many TIC loans are based on 5-, 7- or 10-year fixed rate terms these days (still amortized 30 years) and because most people tend to live in these intermediate homes — including condos and houses alike — for the same time, you might as well save some money doing it.

The Best of Old and New

The best of both worlds. TICs are located within older buildings in the more popular parts of the City (Noe Valley, Hayes Valley, Pacific Heights, Telegraph Hill, the Mission and so on) but will often contain units that have had the “This Old House,” treatment that combines modern amenity living with buildings with period details and character. Because it’s tough to demolish and rebuild historic buildings creative designers and developers have turned old-facade buildings into fully modern homes on the inside that most often can only be TIC units lest units get removed from rental inventory

Putting A Legal Swimming Pool: Going Condo

A TIC may represent a potentially great investment opportunity. Depending on the unit a TIC may be able to convert into a condominium unit that has its own title deed and is exempt from the rent control portions of San Francisco’s Rent Ordinance. For TICs that can convert, a TIC is really like a pre-condo with loads of value just waiting to be unlocked (unless it has already been unlocked, most common in 2-unit buildings, but you never know if there are developers and owners who have to do up a property nicely). Most agents will play this up in their marketing. There is a bit of uncertainty for units in 3- and 4-unit buildings however as any conversion to condominiums would depend on the return of the condo lottery to San Francisco. Just when that will happen is unclear as of this writing (2023).

There is a whole lot of background, caveats and questions that will determine conversion eligibility that we can explore with you. Suffice to say, unless you know a building can go condo, assume that you will be a TIC for the foreseeable future and just be happy with that. (By contrast, if you are considering a unit in a 5+ unit building that did not qualify to convert under a special schedule the City and property owners worked out in 2013, then you will be in a TIC for good, which should be reflected in the property price).

(Note: the Rent Ordinance applies to original subdividers so you can effect any backdoor evictions

How Different Are TIC Prices and Condo Prices? Let’s look at the data.

Live San Francisco MLS Data comparing median sale prices for TICs and Condominiums

Part of determining real estate value is what the market of ready, willing and able buyers there are for a particular property. In the case of TIC sales, the pool of willing buyers is most likely lower, which means the demand for a TIC unit will be less, which will likely lower the final purchase price unless there’s something special about a TIC like the fact it’s conversion ready, views, location, finishes, or historic significance/vibe for example.

Let’s explain what is TIC is by telling you what you don’t get when you buy a TIC unit.

When you buy a house or condo, you’re buying a bundle of ownership rights over a piece of real property that is symbolized and communicated to the world by a title deed. That real property, of course, is derived from the sovereign (aka, the people who had the swords who conquered the land and who brought enough order to give/sell/grant land to folks — you know, to the victor goes the spoils).

Back to those grants. Those grants were then divided into various divisions by the states, starting with counties, townships, sections, fractional sections, and rods — all the down to the parcel which, in San Francisco, is usually about 25 ft wide x 100 ft deep with lots of exceptions of course for bigger parcels that are wider and deeper — which is especially the case for apartment houses that many TICs are derived from.

For condominiums, the parcels get smaller and smaller with many fitting into the footprint where one house may be and extend into 3 dimensions (some condo buildings have elevator shaft parcels; think air rights in New York for a loose analogy).

Regardless, each parcel will have its own assessor parcel number and legal description which may be as extensive as to talk about metes, feet from this origin point or that, or be as simple as, Book X and Page Y. Each land parcel is individually mapped, numbered and on record with the local county assessor, treasurer or recorder’s office and are a matter of public record.

Most important, each of those parcels will have its own separate title deed. Condos are subject to restrictions that run with the land in the form of CC&Rs — conditions, covenants and restrictions — and these regulations have the power and force of property law behind them.

A TIC building/development with various units and corresponding fractional ownership interests (usually based on square footages), by contrast, will only have a single assessor parcel number and the agreement that says you get Unit 1 and I get Unit 3 with someone else getting Unit 2 is governed by a tenancy-in-common agreement, which is a matter of contract law (which means its subject to different legal principles, interpretation and are easier to change)

What You’re Really Buying — The Sharing Economy

Going into even greater detail: Instead of getting your own title deed like you would with a condo or a house purchase, when you complete a TIC unit purchase you end up with an undivided interest in the parcel’s single title deed.

The precise space, the effective percentage of the HOA that you’re buying into will be determined by that private contract between the TIC owners we mentioned above that’s commonly referred to as a TIC Agreement.

It’s more likely than not that your TIC Agreement will have been written by one of 3 law firms in the City who all either worked with each other at one point or had lawyers come and go between the trio of firms. Each firm has a different way of preparing their TIC agreements for a given building (there is only one TIC agreement per TIC building, although there may be different versions of the document prepared over time), but the variations are usually more subtle as there is a lot of standard stock features you’ll find in any TIC Agreement (e.g., establishing an HOA, voting rights, allocation of common expenses, budgeting and rental policies among more).

How Do I Pay For the TIC?

Cash is always welcome... but if getting a mortgage? Good thing that the market innovates to on-the-ground conditions

It used to be that TIC loans would be group loans where everyone was on the hook for everyone else. That or there may be the situation where folks would buy a big building, use the Ellis ACt to clear it out and then offer seller financing so you ended up with the strange situation where fellow HOA members could hold mortgages for the others.

Thank goodness for the advent of the fractional mortgage loan that did away with those two forms of TIC financing. These loans have also evolved over time as they were only ever adjustable rate mortgage initially (based on a 30 year amortization) with fixed terms lasting from 3 to years (which was premised on the ability to enter the condo lottery and convert).

Since the suspension of the condo lottery and the acceptance of TICs as a regular part of our housing market, lenders are now (as of 2022/2023) extending 30-year fixed fractional TIC loans with pretty competitive rates (sometimes alternating being .5 percent less to 1 percent above conventional loans).

If you want to buy a TIC unit and you want to get a mortgage on it, you will likely be talking to the same group of lender representative and the occasional mortgage broker who handles these types of loans.

While the names of the lenders they‘ve spread the TIC gospel to may have changed, the folks who do TIC loans have remained consistent. The current lenders who do fractional TIC loans:

- National Co-Op Bank (based in Ohio actually)

- Meriwest Mortgage

- Bank of Marin

- Bank of San Francisco

- Redwood Credit Union (will not lend on any building with an Ellis Act within the past 10 years)

*This list can (and will) change over time so check with us for the latest information.

IN-DEPTH QUESTION

Why Do TICs Scare Offer Most Other Lenders? Does this Mean You Should be Scared to?

You may have heard horror stories of folks who owned TICs but were on a group loan with their fellow co-owner/neighbors where one person would just get up and go leaving the other owners behind to cover their mortgage or, in the fractional loan setting, their share of property taxes that come due.

Most group loans are now gone (thankfully) and many HOAs will maintain higher HOA reserves/savings so that they have a cushion ready to pay property taxes (some may even have an impound requirement whereby you pay your share of property taxes every month instead of the two times a year everyone else has to pay).

These types of risks are too much for many lenders and their underwriters to handle as it requires time, extra effort and willing investors who will buy this type of mortgage debt (that or lenders will carry TIC debt as part of their own portfolios).

Lenders doing conforming conventional loans (i.e., ones backed by Freddie Mac and FannieMae) must apply a set of universal guidelines for all their loans nationwide. High value/priced markets like San Francisco will see upward adjustments of loan limits. And while conforming loan guidelines may be more generous than, say, ones for jumbo loans, there isn't enough leeway in those loan guidelines to accommodate the circumstances you see for fractional TIC loans. This limits the available lenders from the hundreds or thousands to the handful we discuss in this section.

(NOTE: contrast a fractional loan to a family or group of individuals buying a single property as tenants in common. These folks can still get a conventional loan because the property itself is still a whole and all of the individuals on the loan are still responsible for the entirety of it together, plus a lender can foreclose on the entire property if there is a default; that right is expressly disclaimed by TIC lenders, which would be too much for a conventional lender (and the folks who buy their mortgage-backed securities) to handle).

Be Careful, Everyone Must Sign the TIC Agreement in a Building, Or Else...

Like we said above, a TIC purchase, on its face, is a purchase of an undivided ownership interest in a given piece of real property. TIC agreements not public record but all the owners in a building will have a copy of the document and each will need to sign updated versions over time as units are bought and sold.

Suppose you didn’t sign the TIC Agreement for an established TIC building and your purchase closed, you could occupy any part of the property. Conversely, if future buyers in the building don’t sign onto an existing TIC Agreement, they too may have the right to barge into your unit and take over it.

The sheriff would be powerless to do anything at first. Therefore, it’s essential to (1) have a comprehensive TIC Agreement that delineates each owner’s space and occupancy rights within a building – “unit 2A,” for example, which will usually reference a chart somewhere in the agreement along with areas that a unit is assigned to use exclusively; (2) every owner must sign the TIC agreement at one point to symbolize their acceptance of each owner’s space; and (3) every selling owner and new would-be owner buying a TIC interest must sign an Assumption and Release document that memorializes that the seller is relinquishing and releasing any ownership rights in the property (lest they get to come back after the sale and hang out in their old living room).

The above should give you some indication as to why many lenders avoid TICs altogether no matter how unlikely people are to leave something as important unsigned.

Screening Out TICs?

It may feel like a dastardly plot or tease that TICs are oftentimes show up as a condominium in a given real estate search tool. But because no one else really has TIC units on the market (LA, as of this writing has under 1,000 of them), many online property search outlets will handle TIC listings as condominiums generally but may be accurate if there’s a subcategory field.

Agents, for the most part, are being true and entering TIC listings as such. Trying to mischaracterize a TIC as a condo is a no-no and agents run the risks of fines and penalties if they purposely try to mislead folks. Agents lack the ability to control how their listing gets handled and displayed by outside vendors.

Disclaimer

How could we not add one here for such a complex topic? Well consider yourself alerted that this type of a property type can be complicated, just like San Francisco is. Before proceeding with a TIC purchase (or even a TIC project if you are a developer) you should consult the appropriate lawyers, agents and other professionals who can help you make the best decisions possible. Inclusion of the folks on this page is not necessarily an endorsement of any of them, although we can say we have worked with each with successful outcomes.

What Else?

Some potentially relevant links and pages to consider