2022 To Date — A Busy and Dramatic Year

From starting quietly, to rising feverishly, to stopping suddenly, 2022 has been fast and furious. And we are only halfway done. As we look back, here's what we've seen.

What Sets San Francisco Apart from Other Places and Other Markets

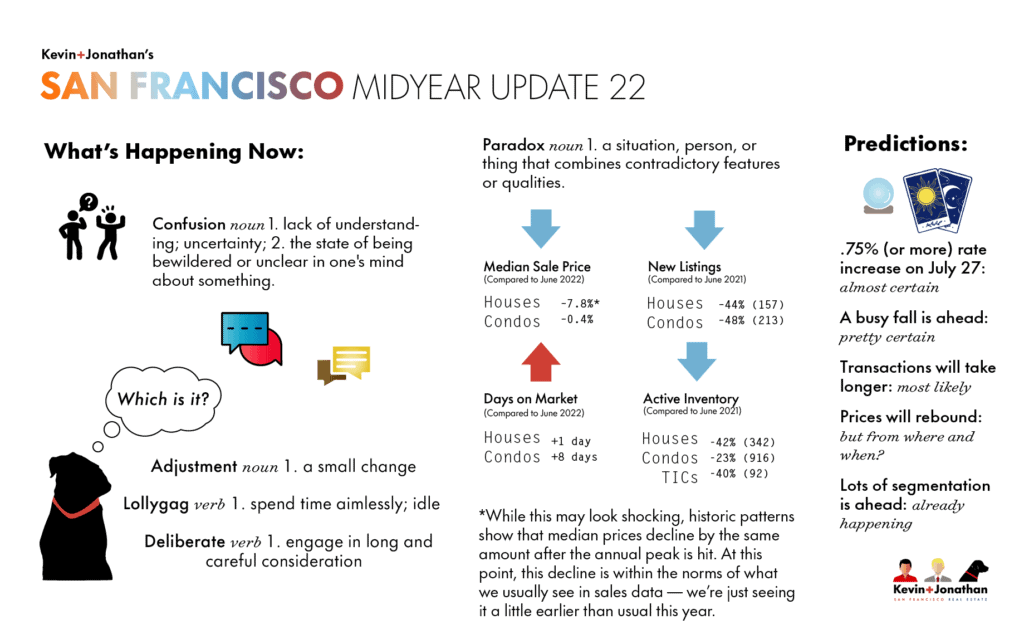

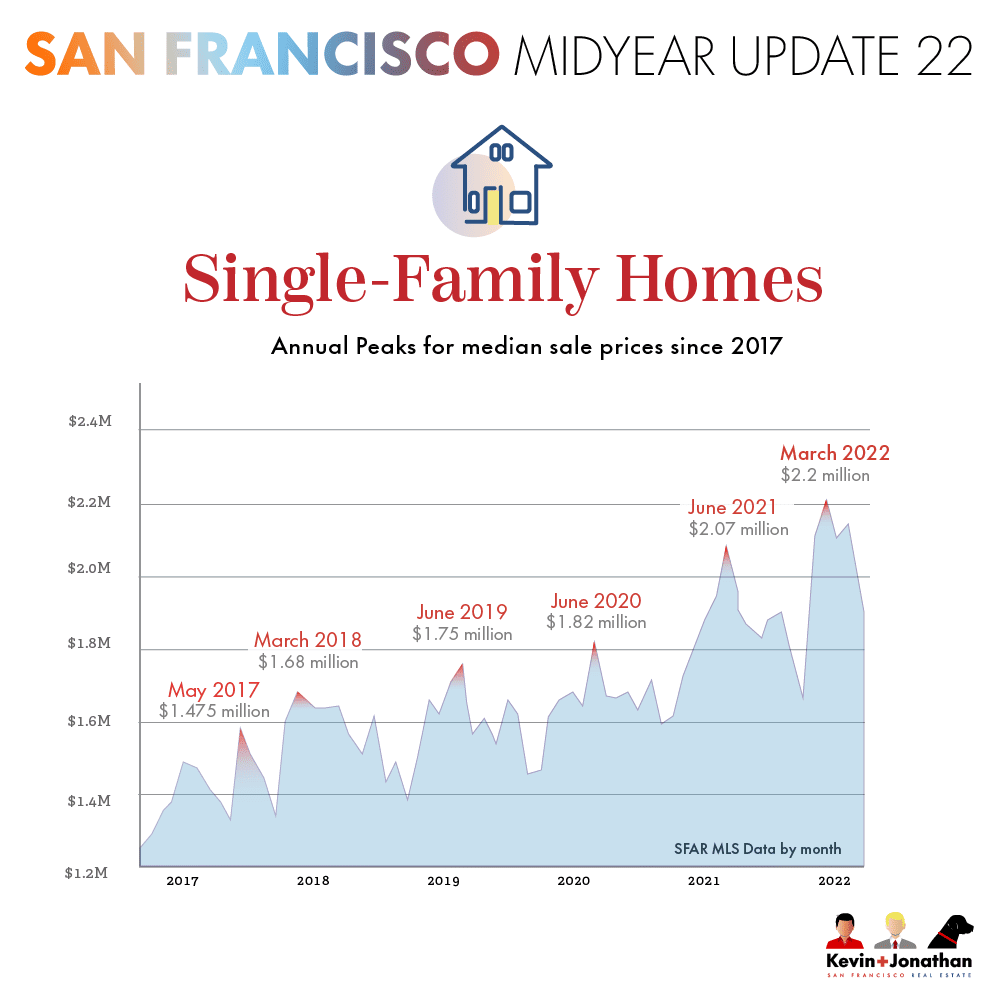

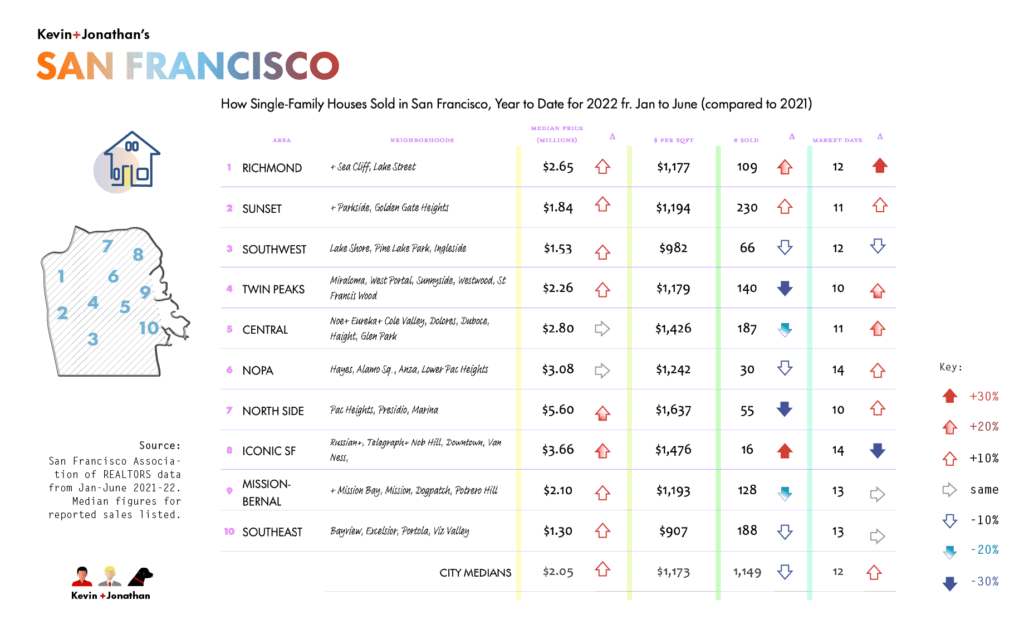

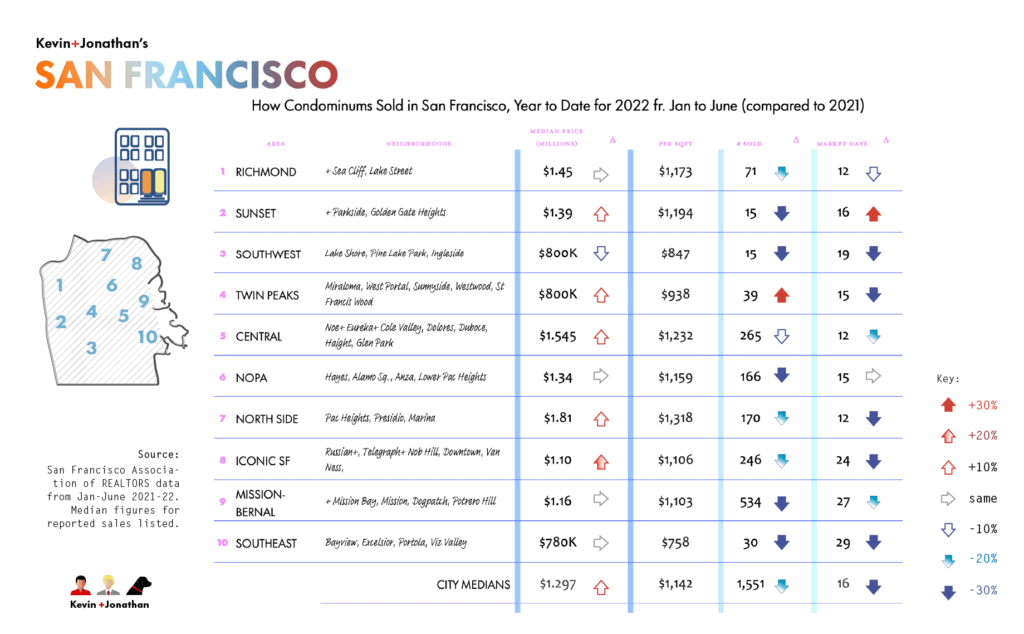

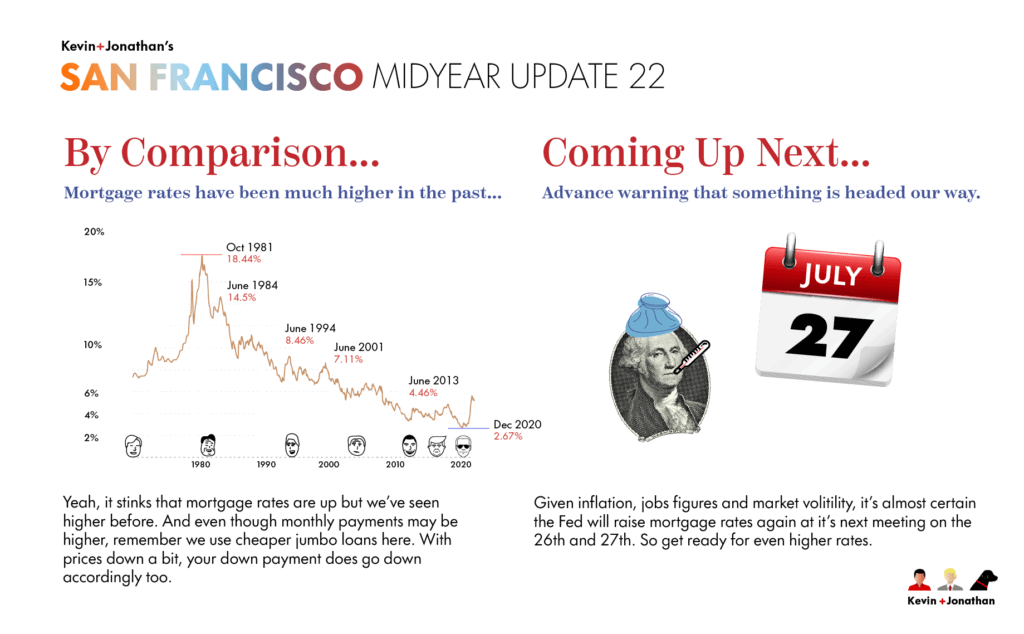

Every year we try to do an annual report on the market and the year that’s ending. When we have time, we like to do a Mid-Year Review too. The past two years have focused on the impact of the Pandemic and this year’s Mid-Year Review grew even more complicated, but here’s our attempt. June’s .75% rate hike was a catalyst that slowed the market down and accelerated our normal seasonal lull. This month’s anticipated rate hike will likely take effect on July 27. Because the rate was higher and impacted affordability it was also very newsworthy. The attention-grabbing headlines foretelling doom doom have followed of course as it’s human nature to dwell on change, uncertainty and anxiety. But don’t forget to look past the headlines and remember that we do stand apart here in San Francisco in so many ways. For our purposes we note that many folks buying property do so with cash. If there’s a mortgage involved it will unlikely be the type the headlines are about (a conforming conventional) but, thanks to our prices, jumbo loans. Jumbo mortgage rates have been averaging anywhere from .75% to 1% less than conforming loan rates. And, as you'll see below, our selling season is also out-of-step with the country where our summers are the slow part of the year rather than the busiest. The chart below shows this regular pattern we see every year:

Some Context Setting About Mortgages and Real Estate

As you can see, we’ve seen far higher interest rates in the past and witnessed marked growth all the while. The big picture tells us that market awkwardness will pass eventually. Until it does, however, we do have to remind ourselves of why real estate is a special asset class.

Beyond the emotional factors and benefits of owning, don't forget that you can’t live in or paint an index fund. You can’t lease them out either last time we checked. Combine that utility with the various tax benefits afforded to real estate and you can see why real estate is considered a hedge against risk. But for the foreseeable future, we’re advising our clients to maximize their positions now the best they can. July’s rate hike is expected to be followed by a another increase on September 22, 2022. There are 3 or 4 more scheduled afterwards too as the Fed looks to cool down this unusual economy (there are signs it may be working already as fuel and lumber prices are starting to moderate). But until a new equilibrium is reached (from which prices will hold steady and resume appreciating, affordability issues will come to the fore each time rates go up which will moderate list and sale prices if there are fewer ready, willing and able buyers out there.

Until then, here’s our take on making the best of where we are at currently if you're a buyer or a seller.

- For buyers, being able to demonstrate that you’re indeed serious, ready, willing and able to go with a solid, non-contingent offer is key to winning properties that may have otherwise been unattainable earlier in the year. Competition for properties is down (instead of 10-12 offers, we’re starting to see properties get 3-5 offers or none for that matter). This is happening for least two reasons: (1) the folks who had the cash, confidence and willingness to buy already did so earlier this year; and, (2) right or wrong, buyers who would otherwise be making moves in the market are holding back out of caution or out of the hopes that prices will go down even more, so while other buyers sit out, this is an especially opportune time to make a move before rates go even higher or when more buyers start competing again.

- For sellers who can afford to do so, it would be wise to hold off on selling until we get to the fall if possible. The fall market is always very strong in San Francisco. If only because of the improved weather, this year may be an especially advantageous to hold a listing off until then because it will give buyers more time to adjust and acclimate to a new economic reality. It will also behoove sellers to prepare their properties to the highest level of detail and quality to attract buyers willing to make a move and, ideally, to compete over an exceptional and appealing property. Last, this type of fluid market whereby buyers are more empowered than they have been will require that seller property disclosures be as air-tight and thorough as possible so as to prevent any potential buyer cancelation based on a perceived failure to disclose something fully.

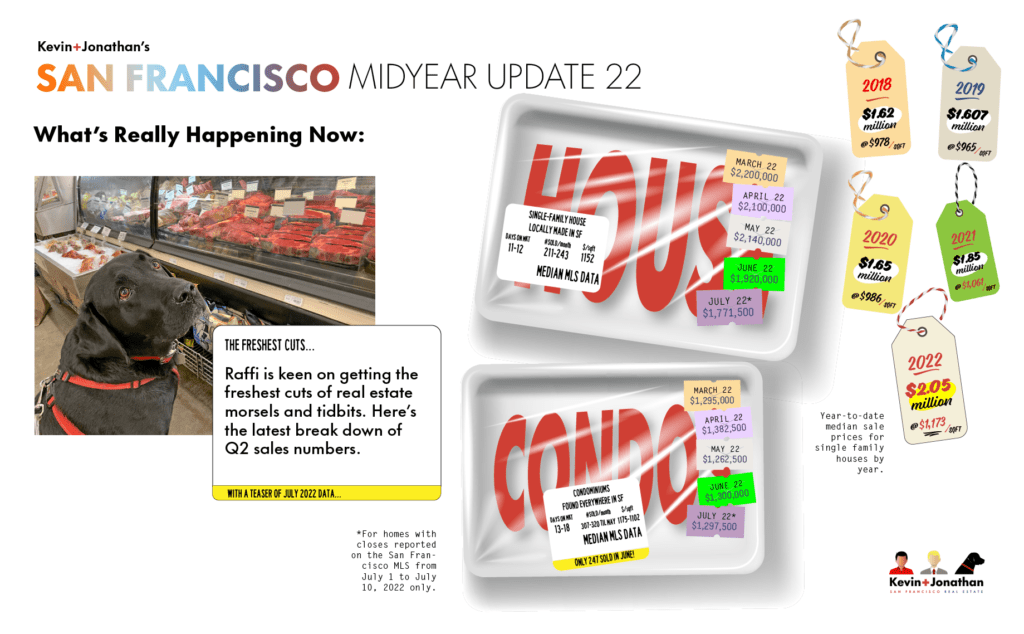

You can see the inherent tension between buyers and sellers is more pronounced than usual. On the one hand, many buyers are refusing to budge on their budgets (by choice or by circumstance as affordability continues to be diminished with each subsequent Fed rate hike). On the other hand, many sellers (and their agents) will want to hold out for a strong sale price and may be able to afford to do so because of a low mortgage rate or the ability to rent a property out to capture still-rising rents. Because the gulf between these two positions appears to be growing ever distant and wide, days-on-market figures have been increasing that much more with sale prices also coming back down off of their springtime highs. In other words, we’ve reached a more normalized market.

Act Now: Operators are Standing By

A rare window of opportunity has opened up. We were asked to write something for the San Francisco Chronicle Sunday Real Estate Section asking about inflation and home prices. That got us to thinking.

The price inflation we’ve all been experiencing and that the Fed is fighting with rate hikes is different than the price growth you’ve seen in Bay Area home prices. If new construction was a big part of our market, then the supply chain issues and labor cost factors that have caused economy-wide inflation might explain the higher-than-normal price growth we’ve seen the Bay Area since 2021.

But our home prices rose faster than usual because of Pandemic-altered buyer preferences and a sense that low mortgage rates weren’t going to last much longer, which proved correct. The rate-hike medicine the Fed has prescribed to fight price inflation for goods and services takes time to work but has had the immediate side effect of arresting home prices.

No one knows how long the lag between a rate hike and when its effects show up in the economy will be. We do know that it’s now become an opportune time to act as Bay Area home prices will go up again as soon interest rates hold steady (if they haven’t already started going up by then) as the fundamentals here are sound and there are good deals to be made. Land is scarce, development is tough, and people still want to live here.

The Latest Market Stats and Data

Check out all the indicators from San Francisco’s dynamic housing market with our live data feed from the MLS itself via InfoSparks.