On Buying A 2-Unit Building in San Francisco

Is Two Better than One?

At some point during or before our work together, you might find yourself thinking: maybe a 2-unit building is the way to go. (You’ll rarely hear anyone in San Francisco call them “duplexes,” by the way.)

Maybe it’s the promise of extra space, the chance to live in one unit while renting out the other, or the appeal of housing extended family nearby. Or maybe you’re thinking like an investor—buying with friends and planning ahead for a fast-track condo conversion down the line.

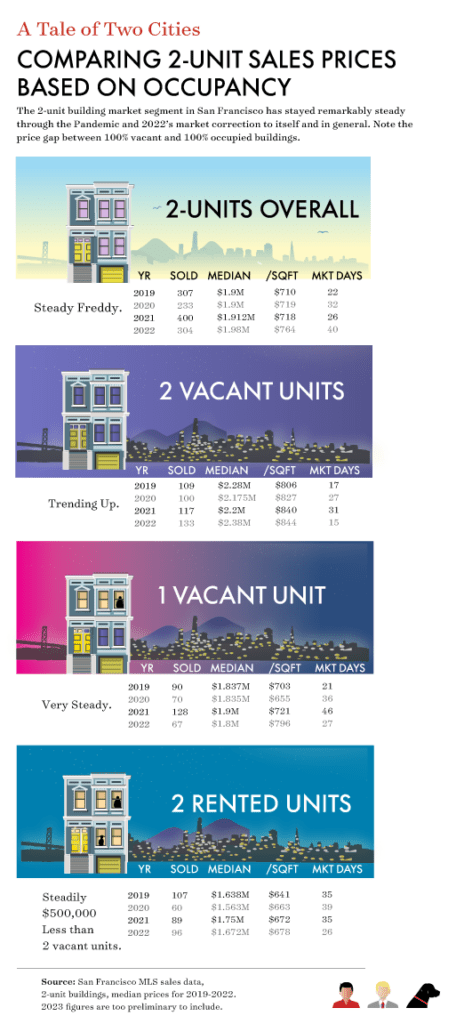

Then comes the price shock: some 2-units are just over $1 million, while others can soar past $7–10 million. What’s the deal?

This section unpacks what drives those price differences, and what you should keep in mind when deciding if a 2-unit property might work for your lifestyle, goals, or investment strategy.

Two Houses, Very Much Unlike

Even in 2025’s lumpy market, a large, clean, vacant 2-unit building can still command $3 million—even as a fixer. And yet, at the same time, you might see a charming, well-presented 2-unit in Russian Hill or North Beach struggle to get traction at just $1 million.

Why? Context matters. Condition, layout, tenancy, location, and future potential all play huge roles—and they don’t always align with what you’d expect from the photos or price tag.

The variation in price and quality for two-unit buildings can be attributed to scarcity and the regulatory state, that can give rise to specific circumstances for a given property (e.g., little incentive to maintain low rental income buildings vs. huge incentives to get a building ready for condo conversion buyers). Specifically, rent control and eviction control laws in San Francisco.

CASE STUDIES

HOW DOES IT ADD UP?

Does 1 + 1 = 2? Or 1? Or maybe 3?

In most markets, a property’s location, size, and finishes are the primary value drivers. But in San Francisco, those can take a back seat—especially with multi-unit properties.

Take TICs, for example: two identical units in the same building may have wildly different values simply because one is a condominium and the other is a tenancy-in-common. That difference? It’s all about the building’s legal and occupancy history.

The same logic applies to 2-unit buildings. Value isn’t just about square footage or sparkle. Instead, it’s often about a building’s tenant history (if any), vacancy status, and zoning classification.

Here’s a look at what you might encounter on the open market—and the key questions we immediately start asking.

Consider The Following Fictional Examples

Listing No. 1: The Tenant-Occupied Fixer at 123 Fiction Lane

A 2-unit Victorian/Edwardian fixer offered tenant-occupied, this property sits on an extra-deep parcel in a prime, central location near parks, green space, and public transit.

While there’s upside in rental income, the building comes with deferred maintenance, unwarranted space currently rented, and tenants claiming protected status—all of which bring complexity (and likely delays) to any future use or improvements.

It’s being sold as-is through probate with court confirmation required. No published offer date yet.

List price: $995,000 (which usually has nothing to do with reality)

Listing No. 3: The Flexible, Mostly Vacant Two-Unit at 456 Fiction Lane

This charming, semi-updated 2-unit building sits on a quiet block just outside a popular neighborhood corridor. The upper unit is vacant, bright, and well-maintained with 2 bedrooms, 1 bath, and refinished hardwood floors. The lower unit—occupied by long-term tenants at below-market rent—offers 2 bedrooms and 1 bath as well, with modest finishes and independent access.

The property includes separate systems, garage parking, and a shared yard, with light upgrades to kitchens and baths already completed upstairs. The building’s RH-2 zoning and potential for future owner move-in make it a versatile opportunity—ideal for buyers seeking income now and flexibility later.

Priced to reflect both immediate usability and long-term upside, it’s a good example of how 2-units can work for those who want part-home, part-investment.

List price: $1,875,000

Listing No. 2: The 2-Unit That Lives Like a Luxe Single-Family Home at 789 Fiction Lane

A showcase of design and detail, this renovated, 4-level property is legally a 2-unit building, but very much lives like a single-family home. Located on a quiet, tree-lined street with underground utilities, the home features 4 bedrooms, 6 full baths, and 2 half baths spread across a thoughtfully reimagined floor plan.

Highlights include a vast wine cellar, solar panels, air conditioning, multiple outdoor spaces, a chef’s kitchen, and a second kitchen on the walk-out lower level—ideal for guests, entertaining, or flexibility of use. The home sits on an oversized parcel with a secluded garden and views, wrapped in a design pedigree from a noted architect.

This is a statement property with luxury finishes throughout, appealing to buyers who want scale, style, and location—with the 2-unit designation offering flexibility for the future.

List price: $7,995,000

What Did We Read Into The Listings?

The Kinds of Questions We Would Ask About 2-Unit Listings

Is any part of the 2-unit building tenant occupied? If so, what are the rents? How long have the tenants been there? Do they claim any protections under San Francisco‘s Rent Ordinance? Is there a willingness to consider a buy-out?

Tenant Considerations: What You Need to Know

Tenants in San Francisco come with a raft of rights under local rent and eviction control laws. If either unit in a 2-unit building is tenant-occupied—especially both—then valuing the property becomes less about square footage and finishes, and more about rents, timelines, and legal protections. Ownership changes do not reset tenant rights.

You’ll want to ask:

Is any part of the building tenant-occupied?

This determines much of what’s possible now and in the future.

What are the current rents?

These numbers tell you whether there’s short-term income or long-term upside—and how far below market things may be.

How long have the tenants been there?

Longer tenancies often come with lower rent and more protections.

Do the tenants claim any protections under San Francisco’s Rent Ordinance?

If so, buyouts and future flexibility may be limited and require more time, cost, and legal precision.

Is the seller—or are the tenants—willing to consider a buyout?

This can open doors, but it’s always case-by-case.

When you see listings mention “upside potential” or “banked rent increases,” take a closer look. While they may suggest financial opportunity, there are real limits on how and when you can increase rent. You can only realize market-rate rents if a tenant leaves voluntarily or by mutual agreement—and most just-cause evictions come with long-term restrictions on re-renting the unit afterward.

In short: tenant status isn’t just a checkbox—it’s a defining part of the building’s present and future value.

Is the Building Vacant? Great—But Let’s Ask a Few More Questions.

A vacant 2-unit building might seem like a jackpot:

✓ You can set market-rate rents

✓ Explore condo conversion (so long as you are not related to the other owner)

✓ Use the whole building like a single-family home

But… not so fast.

Before getting too excited, it’s worth asking:

How did the building become vacant?

Was there an Ellis Act eviction?

A prior Owner Move-In (OMI) eviction?

Is there a history of “bad” evictions that might carry consequences?

If there was a recent Ellis Act eviction that displaced long-term or protected tenants, there may be strict limits—or outright prohibitions—on re-renting those units, depending on the case history. Similarly, a previous OMI eviction may permanently assign that specific unit as the only one a future owner can legally reoccupy, even years down the line.

In San Francisco, these histories stick—and they matter. A building’s ability to be flexible, rentable, or reimagined is often shaped by decisions made decades ago.

The more restrictions and limitations a property carries—usually disclosed via Rent Board records or in seller disclosures—the more those limitations can affect value, unless offset by other standout qualities like location, condition, or architectural appeal.

Is the 2-Unit also Being Listed as a Single-Family Home?

If a 2-unit property is functionally acting as a single-family house, proceed with caution. Merging two legal units into one without city approval is considered a cardinal sin in San Francisco’s planning world.

If you come across a listing—or agent-only remarks—that say something like:

“Legal 2-unit building that lives like a single-family home,”

that’s your cue to dig deeper.

This usually means walls have been removed, a second kitchen has been eliminated, or other unpermitted changes were made that conflict with the city’s approved plans or permits. In these cases, there’s a real—if infrequent—risk that the city could issue fines, penalties, or require the owner to reverse the changes, even if they bought the property in that condition.

This is also why some agents avoid posting interior photos—to steer clear of calling attention to potential issues. Ironically, the same hesitation applies to unwarranted lower units: agents may avoid posting photos for fear of crossing into unpermitted territory and/or potential lender issues.

Bottom line: if it walks like a single-family but is legally a duplex, ask questions—and then ask us what we think.

Does the listing say anything about fast track condo conversion? How about “eligible”?

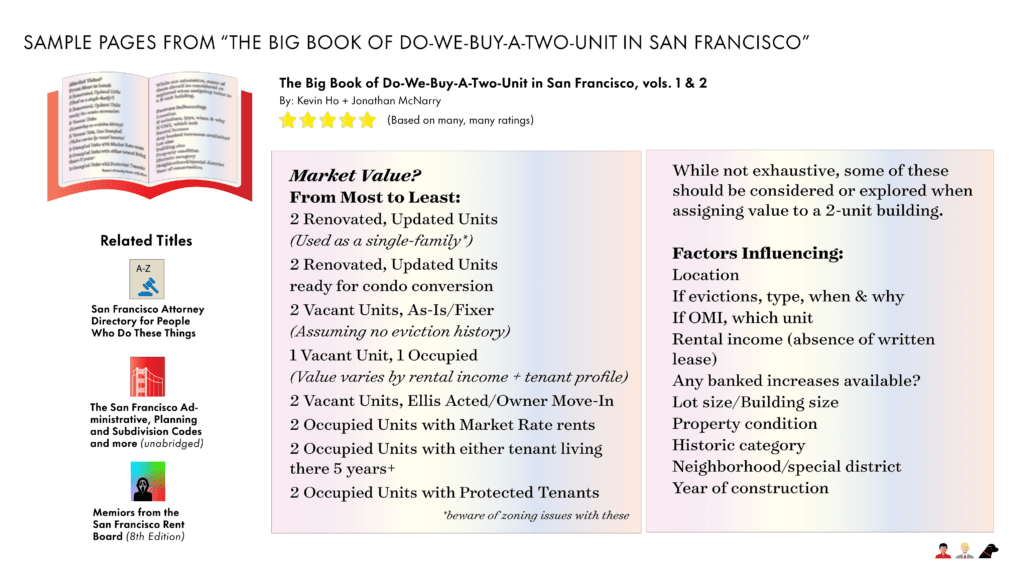

In San Francisco, the highest and best use of a two-unit building has often been to convert it into two condominiums. Since the early 2000s, it’s been true more often than not that the sum of the parts—two condos—is worth more than the whole.

That said, it’s not always the goal. Some buyers prefer to use the entire property as a single-family residence, and sometimes the design, finish, or flow of a home makes that use feel more natural—and more valuable—than splitting it up.

But if a property is eligible for condo conversion, that potential tends to shape how the property is remodeled, priced, and marketed. Savvy owners or developers will often invest in upgrades that align with condo expectations—modern kitchens, private entries, separate utilities—because they know the payoff can be higher.

If that potential isn’t there—or has been blocked—values can shift in the other direction. (More on that below.)

How to Value a Two-Unit Building Based on Your Goals

Two-unit buildings attract all kinds of buyers, each with different end uses in mind—owner-occupiers, investors, condo converters, or those looking for single-family flexibility.

The more limitations a property has—tenant protections, zoning restrictions, or legal entanglements—the greater the discount tends to be.

Your Goals, Your Use—What’s a 2-Unit to You?

Single-Family Use?

Two-unit buildings often offer more usable living space than many single-family homes or condominiums, making them especially attractive for modern, space-intensive living. Instead of waiting years for permits and approvals to build an addition, remodeling existing space is usually faster—and often smarter.

That’s why many buyers look to purchase a 2-unit building and use it as a single-family home. You’ll see these sales on the MLS and in public records, even though this practice is officially discouraged by the City’s Planning Department and the Department of Building Inspection.

Family Compound?

Shifting demographics and cultural traditions that value multigenerational living are among the key reasons some buyers specifically seek out 2-unit buildings. These buyers typically have no interest in condo conversion or using the property for rental income.

Instead, the goal is clear: keep family close.

Because of that, they may care less about past eviction history and may be more willing to pursue options like the Ellis Act, Owner Move-In, or Relative Move-In evictions to make the property fully usable. These buyers are often savvy and experienced, having bought and sold real estate before—and they know exactly what they’re trying to build.

Have Your Real Estate Cake and Eat it Too?

Living in one unit while renting out the other is a popular approach—and for good reason. The ability to supplement your income by collecting rent to help offset mortgage and property tax costs can make a two-unit building feel like the best of both worlds.

While being a landlord comes with its own responsibilities, many buyers appreciate the flexibility: use the second unit for guests, relatives, workspace, or long-term tenants. (Also see: Family Compound.)

One note of caution: if you’re considering short-term rentals or corporate housing in the second unit, be aware that the City has strict regulations and limitations on those uses. Make sure to check the City’s official site on Short-Term Rentals before making plans.

See the City’s website on Short Term Rentals here.

2 Units to 2 Condos (eventually).

One of the most common reasons people buy a 2-unit building in San Francisco is to eventually convert it into two condominiums.

Developers often purchase fixers, remodel them, and sell them as TICs eligible for condo conversion (see below for how to confirm eligibility). Other times, it’s a group of friends buying together, or strangers paired by circumstance when a property is marketed as two TIC units.

To qualify for fast-track conversion, a 2-unit building must have no history of ‘bad’ just-cause evictions—especially involving tenants who were protected due to age, disability, or serious illness, and who had lived in the unit for five or more years. If a building passes this test, it can bypass the (currently suspended) lottery and begin the process of subdividing into two legal condominium parcels, each with its own APN (parcel number) and property deed.

This adds significant value, as each unit becomes a standalone property, free from the shared title structure of a TIC. It also removes the units from rent control, which is why the City strictly limits these conversions.

Note: The definitions of disability and illness are interpreted broadly under local, state, and federal law. The City and Rent Board will defer to these expansive interpretations. (See: SF Admin. Code § 37.9 et seq., SF Subdivision Code § 1359(d), Cal. Gov. Code §§ 12955.3, 12926(i), (k); and 42 USC § 12102(2)(A).)

As an Income Property Only

Unless a property is being delivered vacant, you can forget about collecting 100% of the “projected” rent you may see advertised—especially if the listing comes from a commercial agent. In San Francisco, existing tenants have the right to stay, often indefinitely.

Unlike other cities or states where a sale may break the lease relationship, here, a new owner simply steps into the shoes of the prior landlord. That means all leases, month-to-month tenancies, and even informal promises or agreements carry over.

There are no automatic resets of lease terms or rent rates. So if a unit is occupied, that tenant’s rent and rights stay intact, regardless of the sale.

That’s why it’s essential to review key rental documents—especially the Landlord’s Statement—to understand actual rental income, past communications, and any hidden obligations that may affect your plans.

Have We Seen This Book Before?

Most of the usual factors that help people value houses or condos—location, size, condition, and layout—also apply to 2-unit buildings.

But in this context, there’s an extra layer: the property’s tenant history and any restrictions that may stem from past actions or decisions—many of which could have happened long before you ever saw the listing.

Understanding a building’s backstory is often just as important as understanding its square footage.

Diligence Documents to Examine for a 2-Unit Building

Ideally, the listing agent will have gathered some of the following materials for review—but you can never be too sure.

The stakes are often higher with 2-unit buildings, especially if there are tenants on site, because the issues, rights, and potential limitations may not be immediately obvious.

Below are some of the key documents and sources that can offer insight into how much leeway—and how much value—you truly have with a given 2-unit property in San Francisco.

ORIGINAL DISCLOSURE DOCS

Landlord-owners and their agents are required to provide a disclosure package for 2-unit listings. This should include copies of current leases as well as any side agreements or arrangements the landlord made with tenants—whether formal or informal. These often show up in emails, notes, or casual communications, and they carry over to any new owner.

If we’re lucky, the tenants will also complete a tenant estoppel certificate, where they outline their understanding of the lease: term status, who pays which utilities, deposits, or any special terms.

Also, keep an eye out for unwarranted units or open complaints—especially those flagged in the 3R Report or on the property’s official online permit and complaint history, which you can check here.

Also, beware if there is an unwarranted unit or any other complaints showing up on the 3R report or on the property’s online profile, which you can check here.

SELLER-ANSWERED DISCLOSURE DOCS

San Francisco sellers are required—by both law and standard practice—to provide a series of disclosure forms when selling residential property.

One of the most important for 2-unit buildings is the Vacant Unit Disclosure, which requires the seller to explain how and why any vacant unit became vacant. This can reveal a lot about a property’s history and future potential.

Other essential documents include the Transfer Disclosure Statement, the San Francisco Seller Disclosure Statement, and various rental property information sheets. These are all key to reviewing what a seller knows—and what they’ve chosen to share—about tenancy, use, condition, and potential red flags.

PRELIMINARY TITLE REPORT

Preliminary Title Reports can reveal a lot more than just ownership and liens. In San Francisco, they may include entries showing past Ellis Act evictions or Owner Move-In (OMI) evictions recorded as encumbrances—which can impact future use, rental rights, and condo conversion potential.

You may also see Notices of Restrictions recorded by the City that prohibit unit mergers, subdivisions, or separate sales—often tied to past permits, approvals, or enforcement actions.

These entries are public record, though you might not be able to view the full documents directly. That’s where the Preliminary Title Report comes in handy—and where we dig deeper.

To start your own search, you can look up a property using its Assessor’s Parcel Number (APN) here.

RENT BOARD INFORMATION

San Francisco landlord-tenant records—including buyouts, tenant complaints, eviction filings, and protected status claims—are maintained by the Rent Board, located in their subterranean offices at Van Ness and Market Streets.

The staff is helpful and, depending on how busy they are and the property in question, they can often pull up detailed information about:

Landlord-tenant disputes

For-cause and just-cause evictions

Buyout agreements

Whether a departing tenant claimed protected status

Whether a tenant claimed a right to return to the unit in future years

Although these records are stored electronically, they are not available online—you’ll need to visit in person. That’s actually a good thing: the staff can often help put findings into context, and the Rent Board provides a wealth of printed handouts and reference material that can be incredibly useful.

Two Steps to Making a Two-Unit Work for You.

These buildings can be powerful tools—whether you’re aiming for income, legacy, flexibility, or future conversion. The first step is understanding what’s possible. The next is putting it into motion.

Step 1: Let’s talk about your goals and what a 2-unit could do for you.

Step 2: We’ll help you map out the strategy to get there.

What Else?

Some potentially relevant links and pages to consider